UNLEASHING THE POTENTIAL OF

BLOCKCHAIN AND AI

ON THE GLOBAL MORTGAGE MARKET

Connecting Borrowers and Lenders in a Liquid Global Marketplace

VIA is a digital markets platform revolutionising the inefficient, opaque and illiquid mortgage and MBS market.

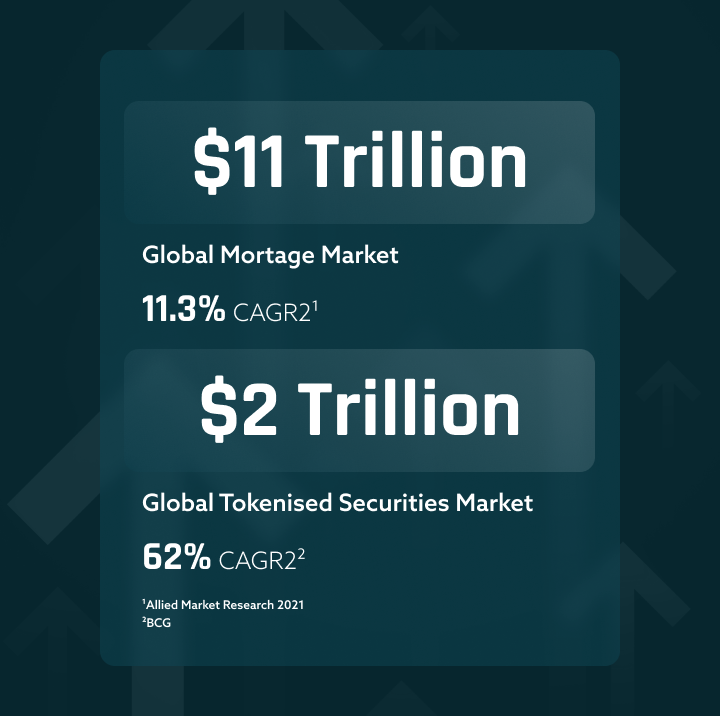

VIA’s end-to-end solution to digitally connect borrowers and lenders is a game-changer for this $11 trillion asset class.

Compelling opportunities are created by making MBS truly liquid, finally making this massive market UCITS eligible.

VIA is disrupting people and paper-heavy processes with blockchain and AI to bring transformational efficiency, speed, liquidity, and transparency, slashing billions in costs.

The mortgage and MBS market has historically lacked transparency, leading to higher costs and risks for investors.

At the same time, the MBS market has become a massive asset class for institutional investors and banks, and an important source of funding for borrowers and originators.

VIA’s blockchain-based solution provides full transparency from loan origination to secondary market trading. Our AI tools significantly improve the quality of due diligence and reduce time, cost and effort.

Our partnerships with originators and brokers in prime markets are building our asset pipeline, initially focused on commercial loans from $10m to $200m plus.

We are driving investor and lender demand via our deep networks and relationships.

Our own VIA Capital funds provide liquidity to deals on our platform and deliver secured facilities to our clients.

Technology is disrupting the legacy financial industry, which is lethargic and constrained by high-cost structures, low motivation to change, and decades old technology and business models.

The future of assets, and private market assets in particular, is tokenised. According to BCG, tokenisation of assets is growing at 62% p.a. and is on track to exceed $16 trillion by 2030 across all investment assets.

Well over half of all financial institutions are interested in the game-changing benefits of using blockchain, both to tokenise and issue securities and to develop and enhance lending opportunities and generate liquidity.

VIA provides efficient access to risk-priced capital as banks are retreating from lending due to regulatory and capital constraints.

VIA provides efficient digital loan origination backed up by high velocity securitisation funding. VIA also finances ‘risk retention’ capital to remove barriers to growth.

Loans can be funded in warehouses and MBS instantly, meaning banks can fully optimise the efficiency of their balance sheets in real time with significantly reduced time and cost friction.

VIA brings better access to deals with reduced friction in due diligence and closing to improve returns. Inherent liquidity & transparency widens the mandates of funds that can invest in these assets.

VIA’s blockchain-based loan origination and servicing system brings transparency and efficiency, leading to lower costs. Smart contracts (digital rules-driven programs) streamline settlements and enforcements and immutably store all loan data and servicing history on-chain for real-time monitoring.

AI algorithms enable accurate assessment and pricing of risk, match and negotiate borrower and lender terms, facilitate efficient due diligence and improve the underwriting process. AI also optimises and automates loan monitoring and servicing, and better predicts defaults, fraud, and market sensitivities.

Tokenisation is widely seen as the future of asset management as it improves efficiency and transparency and facilitates liquid 24/7 trading with instant settlement.

VIA Securities is a tokenisation platform where mortgages, MBS and funds can be issued as digital native assets. Securities can also be risk subordinated (securitised) with a smart contract payment waterfall for various tranches.

VIA Tokens are data-rich digital assets with real-time transparency to improve liquidity and rates. Morningstar recently rated on-chain bonds more highly due to increased transparency.

VIA Markets is a liquid alternative trading exchange built on a public permissioned blockchain and operating under the new Swiss DLT Act.

VIA Markets matches deals with parameters of market participants and enables instantaneous bilateral (on-chain) settlement, eliminating counterparty risk.

Powerful AI tools provide automated and customised due diligence, significantly reducing deal friction.

With a liquid 24/7 market, tokenised mortgages can become UCITS eligible.

VIA Capital is an on-chain fund platform where third party fund managers can quickly and easily set up and manage tokenised funds and credit/mortgage funds that invest in tokenised assets. VIA integrates all services providers and offers real-time reporting and compliance.

VIA manages its own funds to provide liquidity to deals or ‘growth hack’ non-bank lenders by providing on-chain lending facilities with ‘guard rails’ to quickly prove capability. Our lenders then tap VIA’s solution suite to supercharge their lending by access to the wholesale funding.